By Jade Lawton

FIXED interest rates are proving to be a costly mistake for some Berwick residents.

Big banks are reaping a fortune in Berwick, where more than half the homes are mortgaged – 20 per cent more than the Australia-wide average, according to 2006 Census statistics.

Home owners wanting to switch to a variable rate may face steep exit fees costing tens of thousands off dollars.

Berwick resident Rodney Lamb had to sell his family home and move his wife, two daughters, two dogs and two cats to a rental property after his business closed last year.

When he sold his home in February he had to pay more than $25,000 to settle the loan – a huge rise in the price he was quoted late last year when his bank told him it would cost $16,000.

Mr Lamb estimates he lost $40,000 to $45,000 in bank fees and charges when he exited the loan.

“I had a new job, things were looking good,” Mr Lamb said of his decision to take the fixed rate loan.

“What we’d seen in the first half of 2008 was interest rates going up, and I thought it wasn’t a bad idea, although I had never had a fixed loan before.”

Seeing interest rates fall steadily was frustrating for Mr Lamb, who was unable to change to a variable rate without pouring thousands more dollars in to the bank’s coffers.

“It’s difficult; we probably would have had more options. The mortgage would have been reduced by about $600 a month,” he said.

“I tried to contact the bank but I didn’t get anywhere; they ignored me. I wanted to do something – I just felt it wasn’t right.”

La Trobe Liberal MP Jason Wood said five or six home owners had contacted him about the pain that fixed interest rates were causing, and he brought up the matter in Parliament last week.

“Sadly, the future is not bright and rosy for people on fixed interest rates. Banks have been looked after by Australian taxpayers buying in to the Australian dream,” he said.

“I think at least 20 per cent of people in Berwick are on fixed interest rates.

“The only way to make a change is for the public to come forward.”

Gembrook Labor MP Tammy Lobato said she had not been contacted by any of her constituents about fixed interest rates.

“Those who did choose to fix their home rates and are now experiencing financial difficulties should contact their financial institution or a qualified financial adviser for advice,” she said.

“Alternatively, there are financial advisers available through the Casey-Cardinia Community Health Service,” she said.

“Anyone who cannot meet repayments due to losing their employment or due to a change of circumstances should contact their nearest Centrelink office to see if they qualify for other means of support.

“I am happy to meet with and assist any constituents who are facing such difficulties.”

Mr Wood said he would write to Federal Treasurer Wayne Swan and encourage him to talk to the big banks about the fees.

Home owners in a rate fix

Digital Edition

Subscribe

Get an all ACCESS PASS to the News and your Digital Edition with an online subscription

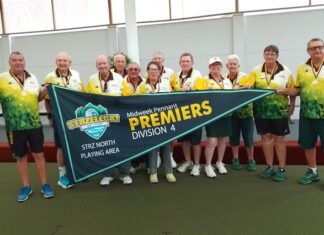

Celebrations begin after well-earned pennant joy for Garfield

GARFIELD BOWLS

Celebrations erupted at the Garfield Arena last week after Garfield 1 returned home from the Morwell Bowling Club with the Division 4 Midweek...